We seek responsible growth, leading with ethics and transparency. At Celsia, being leaders means being visionary, farsighted and genuinely committed to a sustainable future.

GRI (3-3) Having solid corporate governance principles represents one of our essential foundations to strengthen and ensure sustainable relationships with stakeholders. We work to make sure these relationships are based on trust and transparency, which is a crucial pillar for value creation.

We have corporate bylaws, codes and policies that establish the guidelines regarding the operation of management and administrative bodies, which define the way decisions are made, the rights of shareholders, the disclosure of information for it to be timely, clear and sufficient, as well as guidelines for the actions of company employees, among other matters.

These codes and policies are published on our website, guaranteeing all stakeholders access to them. They are reviewed regularly to move towards best practices and adapt to company dynamics. In addition, they are implemented constantly by all employees, who understand the importance of fulfilling their purpose.

Our Management

GRI (3-3) We have corporate documents with guidelines and directives on corporate governance. These documents include clear rules and provisions and are known to both the Board of Directors and Senior Management, as well as all employees, for their proper management and implementation. They can be accessed on our website for continuous consultation.

- Corporate bylaws.

- Corporate Governance Code.

- Code of Business Conduct.

- Protocol for managing conflicts of interest.

Governance structure

Corporate governance

Shareholders’

Board of Directors

Management team

Shareholders’ Meeting

GRI (2-9) The Shareholders’ Meeting is Celsia’s highest corporate body and is made up of all holders of shares in the company. It meets at least once a year (within the first three months) to learn about the results and the most relevant information, as well as to deliberate and decide on certain matters, as established by the corporate bylaws. The above is aimed at guaranteeing the company’s adequate management, administration, sustainability and growth.

The Meeting is a space shareholders have to learn about the management of directors and administrators, make decisions, and present their opinions and recommendations.

GRI (2-13) Celsia’s bylaws (approved by the Shareholders’ Meeting) establish that the Board of Directors will be delegated the broadest mandate to manage the company and, consequently, will have sufficient powers to order the execution or celebration of any act or contract included within the corporate purpose, as well as to adopt the necessary determinations in order for them to fulfill their purposes. Moreover, they indicate that one of the functions of the Shareholders’ Meeting is to delegate one or some of its delegable functions to the Board of Directors, when it deems appropriate and for specific cases, in accordance with current laws, which includes the authority over economic, environmental and social issues.

Ownership Structure

Celsia’s shareholding structure as of December 31, 2023 is as follows:

-

Grupo Argos S. A.

share of 52.93%

-

Porvenir mandatory pension fund

moderate share: 8,01%

-

Protección mandatory pension fund

moderate share: 7,07%

-

Other shareholders

31,98% share

- No government entity has Celsia shares in a proportion greater than 5%

- There is no founding family with shares in a proportion greater than 5%.

Board of Directors

Composition

Click for additional information.

Jorge Mario Velásquez

President Grupo Argos S. A.

Independent

Click for more information

Alejandro Piedrahita

Vice President of Strategy and Corporate Finance of Grupo Argos S. A.

Independent

Click for more information

Rafael Olivella

Legal Vice President of Grupo Argos S. A.

Independent

Click for more information

Eduardo Pizano

Consultant

Independent

Click for more information

Juanita Mesa

Legal VP

Independent

Click for more information

José Manuel Restrepo

Escuela de Ingeniería de Antioquia

Independent

Click for more information

Andrés Escobar

Bien Concreto

Independent

Click for more information

GRI (2-9) For the last 4 years, our Board of Directors has been composed of seven independent directors.

Relevant Matters

GRI (2-16) The following are among the most relevant matters management presents to the Board of Directors for decision-making:

- Financial results.

- Budget.

- Strategy.

- Traditional businesses.

- New businesses.

- Sustainability (environmental, social and governance issues – ESG).

- Innovation.

- Human talent.

- Risks.

- Regulatory issues.

- Project monitoring.

We highlight that management updates the Board of Directors on the matters it has come to know through the different channels they have to interact with stakeholders. Through these channels, directors find opportunities to improve, resolve concerns and meet the expectations of shareholders and investors.

GRI (2-16) In 2023, the following topics were presented to the Board of Directors, among others:

GRI (2-12) The Steering Committee and Board of Directors know discuss and approve the company’s strategy, which has ESG (environmental, social and governance) aspects as its axis, for which the teams involved that work on aspects present the objectives and goals, progress and action plans at the corresponding meetings for managers and directors to establish the guidelines on which we must focus to address these issues and prepare the documents that may be required. Additionally, management made a report on environmental, social and governance issues available to the Shareholders’ Meeting in 2023, at its ordinary meeting.

GRI (2-12) To identify and address our impacts on the economy, the environment and people, management presents environmental, social and economic issues to the Support Committee (Sustainability and Corporate Governance Committee) and the Board of Directors for them to know, analyze, give their recommendations and make decisions on the matter. In this way, the teams in charge of environmental, social and governance issues continuously work on the strategy, activities and action plan for the company, which are presented to the members that make up the Support Committee and Board of Directors.

Election of Members

GRI (2-10) Through the electoral quotient system (unless the appointment is unanimous), the Shareholders’ Meeting carries out an individual election process for the members of the Board of Directors, in which the following elements are taken into account:

- Advance notice with which shareholders must submit their proposals. Proposals that have to do with electing members of the Board of Directors must be presented no less than five business days in advance of the date set for the General Shareholders’ Meeting, in which the respective election will be carried out.

- Gender diversity.

- Recognition of their professional career, experience in business management, diversity of knowledge, and outstanding personal and moral qualities of the candidates.

- Age limit – people who are 72 years old or older cannot be elected, unless expressly authorized by the Meeting.

- Compliance with the requirements by the directors elected in a certain period.

Compensation

GRI (2-19) (2-20) The General Shareholders’ Meeting is responsible for setting the remuneration of this governing body. To this end, it takes into account its structure, obligations, responsibilities, and the personal and professional qualities of its members, their experience and the time they must dedicate to this activity. The company does not have any type of variable compensation established for members of the Board of Directors. People linked to Grupo Argos S.A. do not receive remuneration for their participation in the committees of the Board of Directors.

Training

GRI (2-17) We permanently seek to expand and strengthen the knowledge of the members of the Board of Directors and keep them updated with new trends, projections and relevant issues for the organization, such as new technologies, global utility strategy trends, electric mobility, energy storage, markets and other important aspects. The above facilitates decision-making and ensures the effective and active participation of members during meetings.

Risk Training

- Alejandro Uribe, Market Analysis Director

- Carlos Solano, Director of Regulatory Affairs.

- Claudia Salazar, Director of Human Talent and Organizational Solutions.

- Santiago Arango Trujillo, Director of Corporate Affairs

- The power of your decision.

- The Board of Directors was aware of the risks associated with:

- Occupational Health and Safety.

- business and regulatory issues.

- changes in the sector and reforms.

- legal matters.

- The Board of Directors was also aware of the risks associated with bribery and corruption, cybernetics, and conflicts of interest.

Cybersecurity Training

- Sigifredo Hernández (technology team).

Training in the Risks and Opportunities of Climate Change

- Santiago Arango, Director of Corporate Affairs.

Training in Environmental and Social Issues

- Marcelo Álvarez, Generation Leader.

- Bloomberg team, made up of James Ellis, Helen Kou, Nathalia Castillos, Sharon Mustri and Chris Gadomski.

- The Board of Directors learned about the social issues developed in company projects and progress in human rights issues.

- Technological trends to obtain a low carbon economy.

Assessment

GRI (2-18) Based on the Code of Good Corporate Governance (section 7, chapter III), the Board of Directors and its committees are evaluated by an external and independent expert, during the period for which they were elected. In the year not evaluated under this methodology, they self-evaluate their management. In 2023, the Board of Directors carried out a self-assessment together with management on its operation and structure, and that of the Committees of the Board of Directors and Celsia CEO.

Steering committee

Ricardo Sierra Fernández

The Celsia CEO

Claudia Salazar

the Director of Human Talent and Organizational Solutions

Marcelo Álvarez

Director of Generation

Luis Felipe Vélez

Commercial Director

Manuela Pérez

Presidential Assistant

Santiago Arango Trujillo

Director of Corporate Affairs

Javier Gutiérrez

Director of Central America

Simón Pérez

Innovation Leader

Julián Cadavid

Director of Transmission and Distribution

Esteban Piedrahita

Financial Director

Carlos Alberto Solano

Director of Regulatory Affairs

GRI (2-13) Our Steering Committee is committed to:

The executive level roles directly related to economic, environmental and social issues are:

The Celsia CEO

Director of Corporate Affairs

Director of Central America

Director of Generation

Director of Transmission and Distribution

Financial Director

Director of Regulatory Affairs

In economic and social issues:

the Director of Human Talent and Organizational Solutions

Commercial Director

These roles are part of the Steering Committee and are also responsible for informing the Board of Directors of the company’s environmental, social and economic issues.

TCFD (Governance – a.)

Climate Change Monitoring and Supervision

Conscious of the fact that climate change is humanity’s greatest current challenge, this is one of the most relevant issues brought to the attention of the Board of Directors and support committees, which monitor and supervise the objectives and defined goals related to climate change and the respective progress achieved during the year. They also analyze the impacts it could have on the company’s strategy.

The teams that manage issues related to climate change present the progress of the climate change strategy to the Sustainability and Corporate Governance Committee, in which they give a complete context of how the issue is being managed, what the action plan is and how they are doing with compliance with each established goal and objective. Subsequently, the chairperson of said committee takes the information to the Board of Directors. That is, both its members and the Support Committee actively participate in this issue, making comments, suggestions and recommendations, ensuring compliance with the strategy.

The Sustainability and Corporate Governance Committee meets at least twice a year or when necessary. In 2023, a meeting was held in which the progress, action plans and challenges in this matter were presented. These matters were also presented to the Board of Directors by the chairperson of the committee. Based on what was discussed in these sessions, guidelines are established, and strategic business decisions are made that leverage the fulfillment of goals related to climate change.

Main Results

GRI (3-3)

The Código País survey was completed again in 2023, which is specific to securities issuers in Colombia. It reports on the company’s adoption of the recommendations on good governance practices defined by the Financial Superintendence of Colombia.

The cases reported through the transparency line and the conflicts of interest reported by Celsia’s directors, managers and employees were managed.

Awareness-raising pieces on topics of business conduct, competition, business ethics and good corporate governance were disseminated among employees to continue permeating knowledge on these topics, which are so relevant to the organization for its proper functioning. These awareness-raising campaigns were carried out through various internal communication channels.

Furthermore, the Board of Directors and company CEO were evaluated. The results, once presented to the Board of Directors, will be published on the Celsia website.

We trained the Board of Directors on topics, such as regulation, green hydrogen, the energy market, technological trends, energy storage, innovation, the fraud, bribery and corruption risk prevention policy, and ethical dilemmas

Relevant Fact

Celsia Assembly: Share repurchase and new members of the Board of Directors

Relevant Facts

Celsia Assembly: Share repurchase and new members of the Board of Directors

Topic / Indicator | Own indicators | CSA S&P Indicator | SASB indicator | GRI indicator | TCFD | External assurance |

|---|---|---|---|---|---|---|

Independent members of the Board of Directors | – | – | – | 2-9 | – |

IR Issuers Seal of the Colombian Stock Exchange,

for transparency and good corporate governance, since 2013. (11 consecutive years).

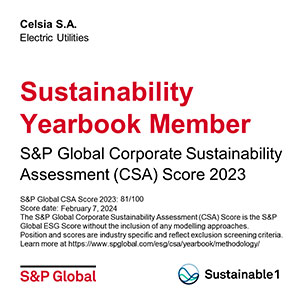

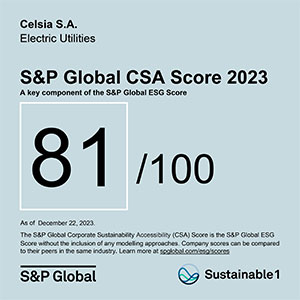

Corporate Sustainability Assessment (CSA)

We were rated as one of the most sustainable companies in Colombia and the world, which means recognition for leadership in managing good social, environmental and economic practices.

S&P Global Sustainability Yearbook

we were recognized as one of the most sustainable companies in the world in the S&P Global Sustainability Yearbook, the only Colombian company in the electricity sector to receive this recognition.

Corporate governance: The system of principles, policies and guidelines that guides the way the company is governed and relationships with the different stakeholders.

Stakeholders: Groups of people, internal to the organization or third parties, with whom we maintain diverse relationships depending on the type of connection they have with the company We receive their suggestions and manage their expectations, which is essential to fulfilling our strategy.

Corporate documents: The documents approved by Celsia’s Steering Committee and/or Board of Directors and/or Shareholders’ Meeting, which determine the framework and guidelines regarding a certain matter, for stakeholders to have parameters of action aligned with the organization’s.