At Celsia, we go beyond energy: we provide social value.

What is VAS?

VAS, or Value Added to Society, is a tool we use at Celsia and all Grupo Argos companies to measure our social, environmental and economic impact. Through this model, we convert the benefits and costs we generate for society into monetary value, in order to make more responsible and sustainable decisions.

Why is VAS important?

Because it helps us:

- Manage risks and opportunities. With a better understanding of our impact, we can anticipate potential problems and take advantage of new opportunities to generate social value.

- Make better decisions. VAS allows us to evaluate the social, environmental and economic impact of our decisions before making them, making sure they are responsible and sustainable.

- Take advantage of positive impacts. If we identify the positive impacts we generate, we can focus on strengthening and expanding them. Mitigate negative impacts.

- Mitigate negative impacts. VAS also helps us identify the negative impacts we generate and develop action plans to mitigate them.

- Be quicker and more adaptable. In a constantly changing world, VAS allows us to be more flexible and adapt to the new needs of society.

At Celsia, we are committed to creating social value in the countries in which we operate. VAS is a fundamental tool to achieve this objective, as it allows us to make responsible and sustainable decisions that benefit society as a whole.

How is VAS calculated?

Economic externalities

Social externalities

Environmental externalities

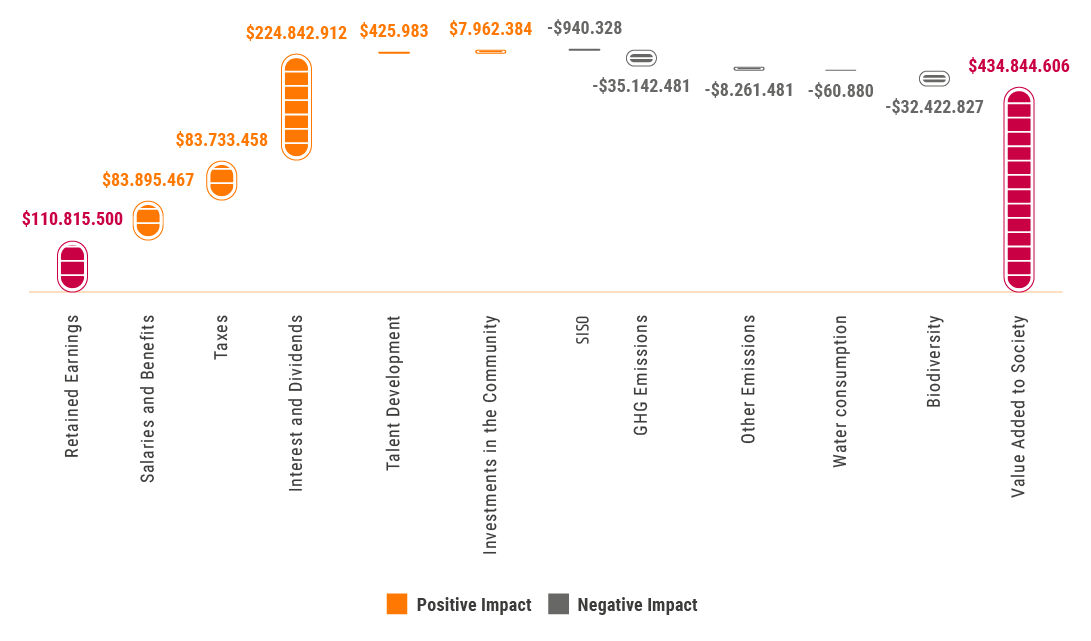

2023 VAS Results

Our net value added to society in 2023 was USD 434.8 million, equivalent to 3.92 times the retained profit of USD 110.8 million.

Understanding the Graph

The results of value added to society that we generate during 2023 are presented in a bridge graph:

- First column: It represents the value the organization retained for itself in the period (retained earnings).

- Next columns: positive (earnings) or negative (costs) impacts on society. They are added or subtracted from the retained profit.

- Last column: Value Added to Society (VAS).

Retained profit

Positive impacts

Negative impacts

Meaning

- An increase in positive impacts: greater benefit for society.

- A decrease in negative impacts (cost): Less impact/harm to society.

Interpretation

- Positive VAS: The company generates more benefits than costs for society.

- Negative VAS: The company generates more costs than benefits for society.

The VAS graph shows how the company creates value for society, considering not only its economic benefits, but also its social and environmental impacts.

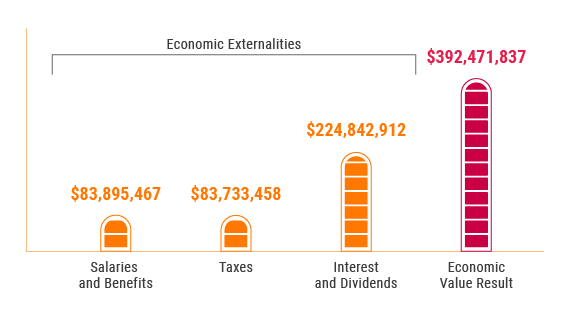

Economic externalities

Click on the image to enlarge.

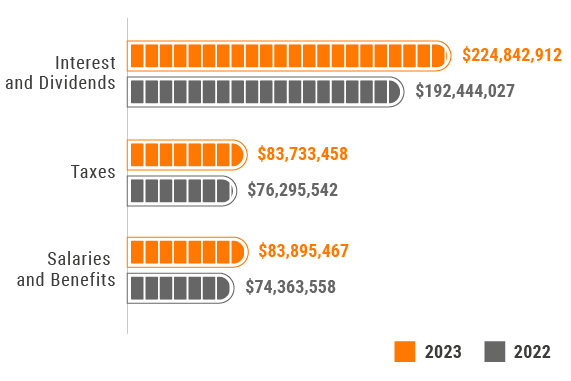

Salaries and Benefits

We can identify how the economy is energized from the positive impact generated by the payment of salaries and benefits to our employees. We invest in their well-being because we know they are the ones who make our growth and development possible.

Payment of salaries and benefits reached USD 83.8 million, increasing the positive impact of the externality compared to the previous year by 12.8%. This is due to the general salary increases, which were higher than inflation in each of the countries in which we operate, aligned with the Compensation Policy. The policy is aimed at managing the remuneration of all employees in an objective, equitable and competitive manner. In addition, two collective bargaining sessions were held, which involved paying bonuses per negotiation firm, which impacts the related accounts.

Interest and Dividends

This externality has two components: Paying interest and dividends to financial institutions (debt payment) and investors (dividend payment).

The positive impacts derived from financial expenses and the payment of dividends were USD 224.8 million, which was 16.8% higher than the previous year. In 2023, dividends registered an increase because, historically, the variation of the CPI has increased and the same payment structure was maintained. Therefore, the company delivers consistent results by distributing dividends to our shareholders in the companies in Colombia, contributing to business growth and strengthening the capacity to create value for all our stakeholders.

Financial expenses also showed high growth, mainly due to the increase in inflation. Gross consolidated debt closed the year at COP 4.88 trillion, with a half-life of 5.16 years and a net debt leverage indicator over EBITDA of 2.34. The balance sheet structure remains strong, as reflected by our AAA investment grade credit ratings. In Central America, a debt of USD 198 million was released after selling the generation assets.

Taxes

We are responsible businesspeople, who are committed to paying taxes in the countries in which we operate. We seek to contribute to the development and revitalization of the respective economies and their collective needs.

The impact on society from paying taxes was USD 83.7 million, which represents a 9.7% increase compared to the positive impact of 2022. This result is due, among other reasons, to an increase in the payment of income taxes in Colombia, associated with the increase in the self-withholding rate, which went from 1.6% to 2.2%. There was a decrease in income, property and other taxes in Central America, due to selling a part of the generation assets in Panama and Costa Rica, as part of the process of resizing our presence in the region and searching for expansion opportunities.

On the other hand, we continued executing projects in 2023 under the Works for Taxes mechanism:

which benefited more than 20,999 people in 22 municipalities in Antioquia, Tolima and Sucre, in Colombia, with more than COP 17 billion invested.

21 km built, with more than 127,000 people benefited and an investment of COP 18.5 billion.

By 2023, we added

in which we have been linked with an investment that exceeds COP 226 billion.

benefited

5 departments in the country.

With these projects, we ensure a true and effective impact on the communities surrounding our operations.

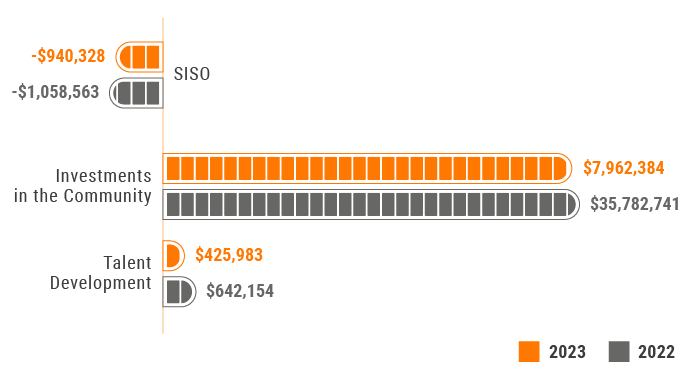

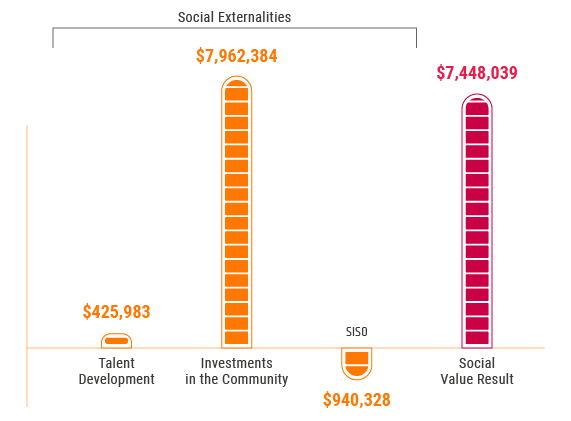

Social externalities

Click on the image to enlarge.

Talent Development

The impact of this externality depends on the rotation of our human talent, the total number of training hours offered and the ratio between men and women at Celsia.

This externality reached USD 425.9 thousand, decreasing by 33.6% compared to 2022.

Although we do not let our guard down at Celsia and we permanently train and develop our employees in programs that promote acquiring skills and helping them improve in managing their role and personal skills, the result of this impact comes from the fact that training hours were reduced due to the company’s budget restrictions during 2023 to face the sector’s regional and global challenges. In Central America, one of the most significant moments was the decision to divest part of our assets, maintaining jobs under the support of a new investor. This measure has generated a reduction in staff but has ensured job stability.

Despite the decrease it presented, this externality continues to have a positive impact on society due to the number of people who are leaving the company, since they take the knowledge and experience acquired with them to apply in new job markets.

Investment in Communities

The value added to society by this externality was USD 7.9 million, 77.75% less than in 2022. This reduction is due to the political and economic context of the country and the energy sector, which resulted in restrictions and budget adjustments in investments. Furthermore:

- Costs were reduced for developing prior consultations (methodological routes) and implementing their agreements, subject to building the projects, since some have barely begun, and others are awaiting environmental feasibility.

- There was a decrease in brand presence issues (80%) and and commercial initiatives (53%).

However, and despite the variations, the impact of the externality continues to be positive. This means, despite the sociopolitical challenges, we continue to bring social value to the communities in our areas of influence. We also support social progress throughour social investment lines Quality of Life, Promotion of Education, Community Development and Access to Energy. In this last line, there was an increase in investment in 2023 due to the increase in network standardization in Valle and Tolima. This was in addition to developing two rural electrification projects, one of them in San José del Palmar (Chocó, Colombia).

Occupational Health and Safety (OHS)

At Celsia, safety is a value, and the health and safety of our employees are priorities for which we work every day for them to return home safe and sound. This externality refers to the impact our employees’ accidents, short and long-term absences, and work-related illnesses or accidents while performing their activities have on society. These are all events we want to avoid at all costs.

In 2023, this impact represented a cost of USD 940.3 thousand. Although it is still negative, it decreased by 11.17% compared to the cost of 2022.

We have maintained the trend of zero fatalities among our direct employees in the last four years, highlighting dedication to safety as an absolute priority. Additionally, 100% of our employees were trained in occupational health and safety. This is equal to 8,272 hours of training during the year.

These actions and the reduction in the cost or impact of this externality on society by 2023 ratify our commitment with the community to ensure the safety of our people, strengthen self-care awareness with our “I Choose to Take Care of Myself” program to prevent these events from recurring, and maintain our goal of zero fatalities.

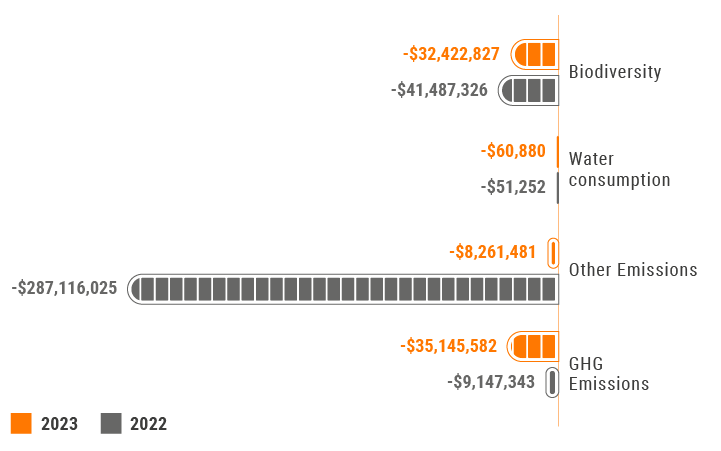

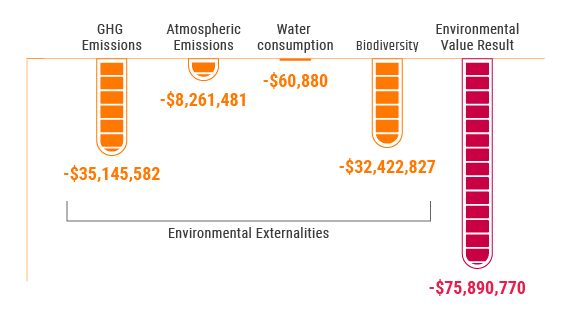

Environmental externalities

Greenhouse Gas (GHG) Emissions

At Celsia, we are aware of the global threat climate change represents. Therefore, we are committed to reducing our greenhouse gas (GHG) emissions and contributing to building a more sustainable future.

In this externality, we monetize the impact of our scope 1 and 2 greenhouse gas (GHG) emissions. In that sense, we reached a cost of USD 35.1 million, with an increase of 284.22% compared to the previous year. This behavior is due to:

- There was an increase in scope 1 emissions, because non-renewable energy consumption increased due to the fact that thermal plants in Colombia and Central America had a greater share in the generation basket, going from 170.8 GWh-year in 2022 to 1,007.5 GWh-year in 2023 due to the low hydrological conditions caused by the El Niño phenomenon.

- Scope 2 emissions, in contrast, decreased 48.7%, due to the implementation of the loss reduction plan executed in Tolima and Valle del Cauca. It should be noted that the main emissions in this scope are associated with purchasing imported energy from the network and transmission and distribution losses.

We obtained Celsia’s carbon neutral recertification, awarded by Icontec, which ratifies our effort to fight climate change with a comprehensive plan to reduce our emissions and compensate for residual emissions, to achieve a balance of zero scope 1 and 2 emissions.

- We take proactive measures that reduce our carbon footprint. For this reason,, we have proposed to reduce the intensity of GHG emissions associated with energy generation by 25% by 2025 (base year 2015). With this plan, we achieved a 61.84% reduction in emissions intensity.

Our renewable energy generation projects in 2023 avoided the emission of

We are thus contributing directly to the energy transition.

Atmospheric Emissions

This externality allows us to quantify the impacts on air quality associated with atmospheric pollution, derived from NOx, SOx, mercury and particulate matter emissions.

In 2023, this externality was negative; the costs generated to society derived from these emissions amounted to USD 8.2 million. However, compared to 2022, the externality decreased its impact on society by 97.12%. These results are due to:

- Though we have a thermal operation in Colombia, the greatest contribution to this externality in 2023 was in Central America, where there was a considerable increase in NOx and SOx emissions compared to 2022 due to the type of fuels used (Diesel and Bunker). It should be noted that the organization’s thermal plants in the Colombian electrical system are backup plants to guarantee the energy demand of the countries in which we are present. PM, NOx, SOx pollutants are not emitted in densely populated areas or close to them.

- In Central America, we had an increase in PM emissions of 13% compared to 2022 due to the consumption of Diesel and Bunker fuels used in the Cativá and TG’s thermal plants (Colón Thermal Complex) in Panama.

There were no mercury emissions in 2023 because we no longer have assets that operate with fossil fuel (coal) in our generation basket.

For the reporting year, we met the established PM goal set by the organization. Moreover, we are within the allowed limits for PM, NOx and SOx, according to the countries in which we are present.

Water Consumption

The efficient use of water resources that we have in our thermal generation operations, and the domestic consumption of our employees in the administrative headquarters and generation plants is what we understand at Celsia as water consumption.

The costs generated to society due to this externality were USD 60.8 thousand, showing an increase of 18.79% compared to the previous year. This result is consistent with the entry into operation of nine new solar farms in Colombia and other transmission and distribution assets during 2023.

This year at the Yumbo administrative headquarters, in Colombia, the Nova building began measuring rainwater collection, reducing the pressure on the consumption of drinking water from the municipal aqueduct that provides the service.

We emphasize that generating hydroelectric power uses water without consuming it, which means less water consumption, despite the captured volumes. The data recorded as consumption corresponds to domestic and cleaning uses, mainly in our assets. In other words:

For the reporting year, we met the established consumption goal, because generating hydroelectric power uses water without consuming it, translating into lower consumption, despite the captured volumes.

At Celsia, we do not collect or consume water in places with water scarcity or extreme scarcity, thanks to tools such as Global Water Tools and Water Risk Atlas. These tools allow the company to identify sites in water stress areas and monitor the availability of water in the basins in which our facilities are located.

Biodiversity

This externality quantifies the impacts on biodiversity due to our operations and facilities, as well as our habitat compensation and rehabilitation programs.

In 2023, this externality represented associated costs of USD 32.4 million, a decrease equivalent to 21.85%, compared to the impact generated in 2022. This ratifies our commitment to continue developing conservation actions and actively caring for our biodiversity and ecosystems.

In 2023, with the voluntary ecological restoration initiative ReverdeC, we planted 3.3 million trees to restore 1,105 hectares in 11 hydrographic basins in the departments of Valle del Cauca (basins of the Riofrío, Garrapatas, RUT, Yotoco, Pescador and Amaime Rivers), Tolima (Combeima River basin), Antioquia (Nare and Aburrá River basins), Atlántico (Canal del Dique basin) and Risaralda (Otún River).

We contribute to the conservation and restoration of strategic ecosystems, such as tropical dry forest, humid montane, high Andean, páramo and mangrove forests, strengthening community nurseries in all regions in which we are present and generating local employment for community-based organizations.

Figures 2023

The ReverdeC Foundation, created in 2022, also has the following challenges:

- Continuing to evaluate new lines of action, such as habitat banks and/or biodiversity credits and carbon credits, for the financial self-sustainability of the program and the generation of incentives for property owners and local actors.

- Consolidating the Foundation as a platform in which organizations and people contribute to planting native trees and restoring strategic ecosystems in Colombia

Externalities: Any positive or negative impact we generate on third parties. This represents a social benefit or cost that is not compensated in money and is not reflected in the financial statements.

Works for Taxes: A tax mechanism through which companies can pay 50% of their income tax by executing investment projects in the areas most affected by violence and poverty.

EMP: Environmental Management Plan.

PM: particulate matter.